Your cart is empty

Shop our productsWith energy costs increasing astronomically and the Solar Investment Tax Credit (ITC) increased to 30%, now is the time to go solar.

Solar energy is becoming more affordable for homeowners and businesses alike, making it a great option for those who are looking to make a smart investment. Let’s take a look at why you should consider going solar now.

Why Are We Experiencing Astronomical Increases in Energy Costs?

In recent months, many of us have noticed a significant increase in energy costs. While this is never welcome news, it’s important to understand why we are experiencing these astronomical increases.

The Role of Supply and Demand

The recent surge in energy prices has been attributed to the basic economics principle of supply and demand. As global energy demand continues to increase and there is no significant increase in the available supply, price inflation ensues.

This phenomenon typically happens when finite resources become scarce, causing suppliers to charge more for their goods, which ultimately gets passed on to consumers in the form of higher prices.

The immense pressure to meet consumer needs without sacrificing revenue or profits has caused energy suppliers to raise prices in an attempt to balance out the supply and demand equation. Ultimately, this has led to the tremendous spike that we are experiencing today when it comes to energy costs.

The Impact of Weather Conditions on Energy Costs

Unpredictable and sometimes devastating weather can have an unfortunate effect on our wallets, especially when it causes damage to the electric power supply infrastructure. This was felt acutely this winter when most of the United States experienced extremely cold temperatures that led to extended blackouts in several areas.

Without access to reliable electricity for heating and other essential needs, not only were consumers forced to choose between necessities like food and power, but disruptions in the business sector caused serious supply-related issues and drove up energy costs further.

As a result of these changes, many people see higher than usual electricity bills even as the weather begins to warm up. It's a wake-up call that should remind us how important consistent access to power is for modern life.

The Impact of Global Politics on Energy Prices

In a global economy where energy costs are always fluctuating, it can be difficult to stay up-to-date on the latest prices when an unexpected global political event happens. With growing tensions between countries, it can be easy for oil-producing nations to restrict access to their products in fear of running out if war breaks out.

This uncertainty in supply and demand can raise energy costs significantly and leave consumers feeling frustrated by rising home and business expenses that often don't subside as quickly as they spike. Although these events are beyond our control, understanding them and having information on how they could possibly affect us is paramount for people wanting to make sure their households or businesses are not overpaying due to events like these.

What is Solar Investment Tax Credit?

Investing in solar energy is becoming increasingly popular for homeowners and businesses alike, as it allows them to save on energy costs while also taking steps toward helping the environment. The federal government created the Solar Investment Tax Credit (ITC) to make this option more accessible, offering a substantial tax credit for those who invest in solar power.

This incentive has been a great encouragement to many people interested in technology. Not only does the ITC help promote solar energy consumption, but it creates jobs by providing incentives for companies that focus on clean and renewable energy. If you're considering making an investment in solar energy, there's no time like the present with these financial benefits from the ITC!

How Does the ITC Work?

Did you know that the Investment Tax Credit (ITC) and solar tax incentives can help reduce your energy bills? These incentives are structured to provide a credit on federal taxes to individuals who purchase eligible renewable solar systems. The ITC is a dollar-for-dollar reduction of federal income taxes based on the total cost of installing solar. In contrast, state and local incentives may range from rebates to performance payments for every kilowatt-hour of energy generated by your system.

Solar tax incentives vary from state to state, so before committing to an installation, make sure you understand how your state's particular solar incentive works. With such financial support from various governmental entities towards installing renewable energy systems, it has never been easier or more cost-effective for homeowners to switch to greener, more consistent energy sources than before.

What Are The Benefits?

The biggest benefit of the ITC is that it makes investing in solar energy more affordable by lowering your overall cost. This encourages people to invest in solar energy rather than other sources like oil or gas. Additionally, because the ITC is based on a percentage of installation costs rather than an absolute dollar amount, larger projects get larger credits—which further incentivizes investments into high-capacity systems.

Thanks to the Investment Tax Credit (ITC), individuals and businesses can now receive a larger tax break for installing solar energy systems on their property. The ITC savings apply to both residential and commercial solar installations and have been increased from 26% to 30%. These substantial savings make it easier than ever before for us all to reduce our carbon footprint and make our homes and businesses more sustainable.

Solar energy is becoming increasingly accessible as technology advances rapidly, allowing solar installations to become more widespread. Nevertheless, there are still significant upfront costs involved with investing in a solar system, which makes the ITC tax credit incredibly valuable. Many states, counties, and cities also offer additional incentives, so be sure to take advantage of these when you’re considering installing solar panels on your property.

Who Is Eligible?

The recent increase in the Solar Investment Tax Credit (ITC) from 26% to its original amount of 30%, and its 10-year extension for residential solar customers, is a huge development for the renewable energy industry. The new Investment Reduction Act (IRA) bill containing one of the most important provisions, has helped spark the tremendous growth and expansion of solar energy usage up and down the United States.

Anyone owning a home or business can certainly reap some financial rewards if they meet the criteria. Any homes and businesses that have installed renewable energy systems after 2006 are now eligible for a 30% tax credit. Businesses must also be able to prove that they are using renewable energy in their operations instead of just reselling any electricity generated by their system.

The extended and improved incentives offered through the ITC have resulted in more people being able to capitalize on their investments and make great returns while transitioning away from traditional sources of electricity. It's encouraging to see how companies are increasingly turning towards clean, renewable sources of energy, allowing us to do our part in preserving the environment.

Taking advantage of this federal program could also result in considerable savings, depending on the size and scope of your project. Whether residential or commercial, extending beyond 2006 installation dates is a great way to ensure you can take full advantage of the ITC while reaping the everlasting benefits of renewable energy sources.

Why Should You Go Solar?

Solar Power Is A Renewable Resource

Solar energy presents a near-limitless source of renewable energy in that it can provide an uninterrupted supply of energy as long as the sun is plentiful. This makes solar energy stand out from the finite supply of fossil fuels, which are steadily decreasing and will eventually run out altogether.

Furthermore, solar power does not create pollution or the dangerous greenhouse gases that come hand-in-hand with traditional energy sources, making it more attractive for those who want to promote sustainability and care for the environment. For these reasons, solar power stands out as a sensible and viable form of renewable energy.

Solar Power Is Cost-Effective

Installing a solar system may seem expensive on the surface, but don't be discouraged by the initial cost –it's a long-term investment that will pay off. Not only will you save money in the long run by not having to pay for electricity anymore, but maintenance costs are practically nil, meaning even more savings.

Plus, if you're looking to sell your property one day, an installed solar system will increase its market value immensely –you may even eventually make more profit than what you initially paid for it. All of this points to an unambiguous fact: solar power is economically sound and well worth considering over traditional energy sources.

Solar Power is Reliable

Solar panels are quickly becoming a preferred energy source because of their economic and environmentally-friendly properties. Unlike fossil fuels, they don't require fuel to generate electricity, meaning they are not subject to fluctuating prices or sudden shortages.

Solar systems also require minimal maintenance once they have been installed, saving you additional time and money while protecting the planet at the same time. With solar power, your home can remain powered for many trouble-free years, allowing you to enjoy reliable electricity that is also cost-effective and eco-friendly.

Solar Power is Versatile

Solar panels have revolutionized the way we use energy. Not only can they power homes and businesses, but with advances in technology, it is now being used to power our vehicles. This can help save money on fuel costs while also reducing our collective carbon footprint. The various solar energy applications is impressive and constantly expanding.

In fact, more homes and businesses are making solar panels a part of their routine construction plans due to their efficiency, cost-effectiveness, and high-powered output. Solar energy has become an integral part of our daily lives, and is fast becoming the preferred choice for powering our homes and businesses.

Solar Power Is A Smart Investment

Installing a solar system is an investment not only in one's financial future but in the future of the environment as well. With fewer carbon emissions and reduced energy bills, no matter what size business or home you have, you can enjoy government incentives, such as tax credits and energy independence.

Furthermore, investing in a solar system will add value to your property, as it is considered a long-term asset that will remain with the property even after you're gone. Solar energy has come a long way and continues to evolve, so why not make the investment for yourself and for everyone else?

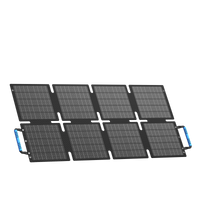

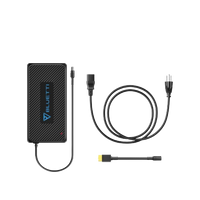

Shop at Bluetti For Portable Solar Generators and Solar Panels

Solar ITC is a great incentive for anyone considering making the switch to solar energy. Not only does it help with the upfront costs of installation, but it also encourages people to invest in renewable energy sources, which helps combat climate change.

If you're thinking of going solar, be sure to research whether you qualify for the ITC so you can get the most bang for your buck. If you're in the market for portable solar generators or solar panels, shop at our store. We offer high-quality products and outstanding customer service, so you can rest assured you're getting the best possible products for your needs.