Your cart is empty

Shop our productsInstalling a solar panel system can reduce your energy bill significantly over time. But, that is not the only way that a solar power system can reduce the strain on your pocket.

A number of tax credits and rebates are available to homeowners who decide to invest in renewable energy generation. If you install a system that meets certain requirements, you may be eligible for rebates on the federal, state, and local levels.

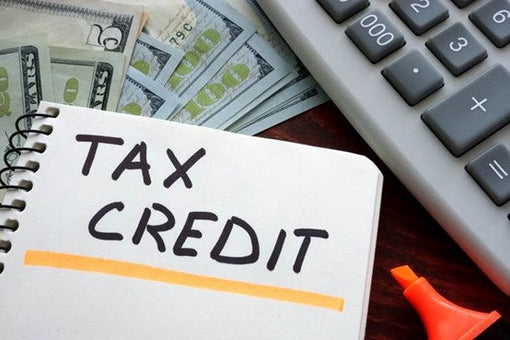

What Are Tax Credits?

A powerful financial tool, tax credits allow you to lower your taxable income and, in turn, your annual tax bill. An income tax credit reduces the amount of owed income tax or increases your refund by the same amount. Both exemptions and deductions are not credits.

What Is The Solar Tax Credit?

Federal tax credits are available for those who choose to use solar panels for energy generation. You will be eligible for a tax credit that will reduce the amount of money you owe in taxes.

In 2006, Congress passed the ITC (Solar Investment Tax Credit). Since then, the solar energy sector in the United States has expanded at an annual rate of over 50% for the past decade, representing a growth of over 10,000%.

Hundreds of thousands of jobs have been produced, and billions of dollars have been invested by the solar industry in the American economy.

A Brief History of Solar Tax Credits

Investment tax credits for renewable energy sources were first established by the federal government under George W. Bush's Energy Policy Act of 2005. Almost all homeowners take advantage of this deduction by installing solar panels. Originally set to expire in 2007, the bill has been extended and revised so that homeowners could receive a tax credit all the way through 2021.

The tax credit for new systems will decrease from 50% of the overall cost in 2020 to 22% in 2021 and to 0% in 2022. You can benefit from the 26% credit if you purchased a solar panel system any time before December 31, 2020, and put it to work any time before the start of 2024.

How To Determine Eligibility For Solar Tax Credits?

You can claim the ITC if you install a brandnew solar power system and begin using it anytime between the start of 2006 and the end of 2023. The ITC will end in 2024 unless it is further extended by Congress.

Other requirements that must be fulfilled are:

- You should be the outright owner of the solar panel system (leased systems are ineligible for the ITC).

- Your system should be located or installed within the United States.

- The system should be situated at your secondary or primary US residence, or for a community, off-site solar project.

Which Solar Energy Systems Are Eligible For The ITC?

In order to qualify for the Federal Solar Tax Credit, a homeowner must install a solar energy system that generates electricity for the home, such as a solar PV (Photovoltaic) system or a solar water heater. The Federal Solar Tax Credit applies to both solar PV and water heater systems because they both use the sun’s light to produce electricity and heat water, respectively.

Solar PV Systems

Photovoltaic (PV) panels, also known as solar panels, are flat structures that look like windows and convert the energy in the sun's rays (in the form of photons) into electricity. Solar panels, which come in thin-film, polycrystalline, and mono-crystalline varieties, are an excellent way to cut down on your monthly electricity costs.

Solar Water Heaters

Using a solar water heater is an affordable option for producing hot water at home. These water heaters utilize the sun's thermal energy to warm water in a storage tank and solar collector installed on your roof.

Calculating The Solar Tax Credit

At this time, the ITC can be used to offset 30% of the total cost of the solar installation. This includes the full price of installing a solar power system, including any necessary upgrades, such as electrical or roof work.

Note that not all extra financial incentives will be factored into the total system price. To illustrate, in addition to the federal tax credit, you may also qualify for rebates from your utility company or the state government. If you want to know how much of a tax credit you can expect to receive based on your individual circumstances, you should talk to a tax professional. The most up-to-date data on incentives, along with contact details for each incentive, can be found onthe Database of State Incentives for Renewables and Efficiency website.

To calculate your solar tax credit amount, you need to start by calculating the total cost of your solar panel system. This would include the purchase price of the system, along with any home renovations/improvement costs and installation costs. From this amount, you must deduct any extra state credits or incentives. The resulting number would be your gross solar panel cost.

Multiply this gross cost by 26% to calculate the amount of tax credit you are eligible for.

Keep in mind that the ITC is not the same thing as a refund. If you file your taxes and are due a refund, you will receive your money after the next tax season ends. On the other hand, tax credits are monetary amounts (gross cost times 26%, in this case) that can be applied to your current or future tax bill.

Claiming The Solar Tax Credit

Form 5695 is the IRS form used to make a solar tax credit claim. The homeowner can deduct the Section 25D residential ITC from their income taxes. If your tax credit is greater than the amount you can deduct, the excess will carry over for a maximum of five years (in certain tax situations, the amount is rolled over into the tax refund).

State-Based Solar Incentives

While the federal ITC is a great incentive for homeowners to go solar, several states, as well as Puerto Rico, also have their own solar incentives. Tax credits, rebates, and certificates for renewable energy are some of the most common of these incentives, though they vary by state. States like California, Texas, Minnesota, and New York offer many financial incentives for switching to solar energy.

These solar rebates and tax credits can vary widely from state to state. Talk to your installer and check the Database of State Incentives for Renewables & Efficiency to learn about specific solar financial incentives offered in your state.

State-Based Tax Credits

Similar to the federal ITC, state tax credits reduce the amount of tax you owe to the state government. The specific amounts vary widely between states, but they should not affect the federal tax credits you're already entitled to.

State-Based Government Rebates

Your solar energy system may be eligible for immediate rebates in some states. You should look into rebates offered by your state to take advantage of the incentive before the money runs out, as they are generally only offered for limited time periods. Solar energy systems may qualify for a rebate of 10% to 20% from the state.

SRECs

Other solar incentives at the state level include Solar Renewable Energy Certificates (SRECs), also known as Solar Renewable Energy Credits.As a perk for installing and registering your solar system with the relevant state authorities, you will receive SRECs on a periodic basis as they monitor your system's energy output. Your local energy provider (or another buyer) may be interested in purchasing your SRECs, and if they are, you will receive a payment that is generally regarded as taxable income.

Additional Incentives

Local Utility Rebate

Utility companies in many areas offer rebates or other financial incentives to residents who choose to install solar panels at their homes. Installing a solar power system may be subsidized in two ways: either a monthly rebate incorporated into energy bills, or a one-time lump sum subsidy.

PBIs, or performance-based incentives, are rebates that compensate you on a per-kilowatt-hour basis for the energy your system generates.

Subsidies on Loans

Subsidized loans may be available from your state, utility companies, or a non-government organization to help you pay for the installation of your solar panels.

Tax Exemptions

After installing a solar energy system, you might not only be eligible for tax credits, but also for some tax breaks. While installing a solar energy system will increase the value of your home, these tax breaks can keep your tax bill from going up.

A few states also offer programs that essentially exempt solar system buyers from sales taxes; taking advantage of such programs can help you save a lot of money on your solar panel purchase and installation.

Can Solar Panels Increase Your House Value?

Having your own solar system installed is the only guaranteed way to increase your home value at this time. Researchers at the LBL (Lawrence Berkeley National Laboratory) found that solar-powered homes in the Golden State fetched higher prices than their conventional counterparts. Homeowners outside of California can still benefit from the "solar premium" that comes with having solar panels installed. However, you can rest assured that using solar panels will increase the value of your home.

How Much Value Can Solar Panels Add To Your House?

According to the Berkeley study referred to above, each solar watt increases your house value by about $4 in California, and by about $3 elsewhere in the US. This means that, even with a modest 2-kilowatt solar system, you can expect your house value to go up by ($4 x 2,000) = $8,000 within California and ($3 x 2000) = $6,000 elsewhere in the country.

According to this study, the amount of value that solar panels can add to a house is largely determined by the utility and installation costs within a particular location.

Leveraging Solar Energy To Reduce Your Tax Bill

You can reduce the cost of installing a solar power system by taking advantage of the available tax credits as well as the other financial incentives discussed in this guide. Although solar panels may have a high upfront cost, these programs will end up saving a lot of money in the long run.

If you are looking for portable solar panels to benefit from the various federal and state-based financial incentives out there, we invite you to check out our wide range of solar products. We offer many different types of portable solar panels, generators, and kits, and can help you find a system based on your budget, location, and saving targets.

Shop products from this article

Be the First to Know

You May Also Like

What Does a 30% Federal Solar Tax Credit Mean and How to Apply?

Governments around the world are offering programs that encourage homeowners to switch to solar energy. Among the most notable programs is the 30% Federal Solar Tax Credit. It reduces your...

Deadly Flooding Devastates U.S. South and Midwest — What You Need to Know