Your cart is empty

Shop our productsBesides the nationwide 30% federal solar tax credit, Ohio offers multiple incentives that reduce the cost of solar installation significantly. While most homeowners are aware of state-level incentives, there are also local incentives that eligible homeowners can take advantage of.

Available Solar Incentives, Tax Credits, and Rebates in Ohio

Ohio residents can benefit from the following programs.

Solar Renewable Energy Credits (SRECs)

SRECs are incentives that are performance-based that allow you to make extra cash from the energy you produce through your solar system. Generally, you can earn a single SREC for every 1,000-kilowatt hours (kWh) or megawatt-hour (MWh). You can then sell your SRECs on the SREC market. However, you cannot sell your certificates to your utility directly; instead, a broker or SREC aggregator will sell them on your behalf.

Like stocks, the SREC price depends on the supply and demand. As you’d expect, the higher the supply, the lower the prices, and vice versa. In Ohio, you can sell your SRECs at $5 per certificate. However, the cost varies depending on supply and demand. So, if you have a 10kW system installed, you can have at least 10 SRECs by the end of the year. This translates to $50 in annual earnings.

Related articles: Minnesota Solar Rebates, Tax Credits, and Other Incentives 2024

Does California Offer Any Incentives for Solar?

Ohio Property-Assessed Clean Energy (PACE) Financing

PACE provides a seamless and cost-effective means to transition into the use of renewable energy sources. It can cover improvements for almost all property types ranging from multi-family, commercial, retail,and industrial in Ohio. This program provides 100% financing for any qualifying project and is repayable within 25 years.

The best part is there’s no down payment as every aspect of the project is covered. And since the rate is fixed, you can access your repayment schedule in advance. To qualify as an Ohio resident, you’ll need to complete a brief form to help PACE determine if your property is eligible for the financing.

Once you qualify, you’ll fill an energy project application form to provide financial documentation about your property. Ohio PACE will share this information with capital providers to obtain financing on your behalf. Upon agreeing to financing terms, the funding will be available and a registered contractor will start the installation of the energy saving system.

Energy Conservation for Ohioans (ECO-Link) Program

The Ohio state government provides a loan repayment program that makes accessing and repaying your loan for an energy-efficient home seamless. If you qualify, you can access a loan at a reduced interest rate. In 2024, homeowners can benefit from a 3% interest rate reduction on bank loans for energy-efficient upgrades in their homes.

However, the loan amount is capped at $50, 000. If the loan is over $25, 000 you can opt for a seven-year rate reduction. Amounts less than $25, 000 automatically qualify for a five-year rate reduction. The ECO-link program allows you to use renewable energy at a reduced price while fostering economic growth, since you can sell electricity to the grid.

Eligible products include heating, water, and cooling systems; weather strips, duct sealing, and insulation. Washers, ceiling fans, and refrigerators also qualify. The ECO-Link program will also cover the installation of renewable energy systems such as solar panels and small wind energy plants.

Cincinnati Property Tax Exemption

Besides PACE and ECO-Link programs, Cincinnati residents can also opt for the Residential Tax Abatement (RTA) program. This prevents an increase in property tax after a home improvement project. With this program, you can increase the value of your home by installing the BLUETTI EP800+B500 but not the property tax for 10 to 15 years.

Your home must, however, meet LEED certification standards. With the program, the government seeks to retain city residents in the area and also attract homeowners from other states. This is thanks to the significantly reduced installation costs. In addition, the program seeks to help Cincinnati residents to grow and develop their neighborhoods. The program has undergone numerous changes over the years.

For example, they introduced a tiered neighborhood system to identify and target those with the greatest needs. They also incorporated the online application option to make the process transparent and accessible. And if your home is regarded as a historical renovation, sustainable building or an accessible home, the state government will prioritize your project.

City of Cleveland’s Residential Tax Abatement

Like Cincinnati residents, City of Cleveland homeowners can also apply for local solar incentives. The program covers rehabilitation and improvements for new buildings to meet the city’s green building standards. Available to both developers and homeowners, it helps lower the cost of going green while spurring investment.

To qualify for the incentive, your property must be in the City of Cleveland and construction must meet the City of Cleveland Green Building standard. If you are building a new house or rehabilitating an entire house, you’ll need a Certificate of Occupancy to qualify. Also, ensure you have a valid permit from the City of Cleveland Department of Building and Housing.

The incentive covers 85% to 100% for a single-family project. However, the amount is capped at $350,000 for new construction and $450,000 for whole-house rehabilitation. Multi-family projects receive an abatement ranging between 85% and 100%. That means installing solar panels with the BLUETTI AC300 + B300 will cost you close to nothing.

Hamilton County Home Improvement Program (HIP)

The HIP is an initiative of the Hamilton County Treasurer and County Commissioners that allows homeowners to access home repair and remodeling loans, seamlessly. It is available to allow homeowners in Hamilton County. You can access the loan through participating financial institutions. While there are no income limits or restrictions, you must meet your bank’s credit requirements.

Eligible repairs and remodeling include decks, bathrooms, plumbing, garages, solar installation, carpet installation, and other improvements. If you qualify, you will receive a loan at a rate 3% below the lowest rate your bank can offer. It is repayable in five years.

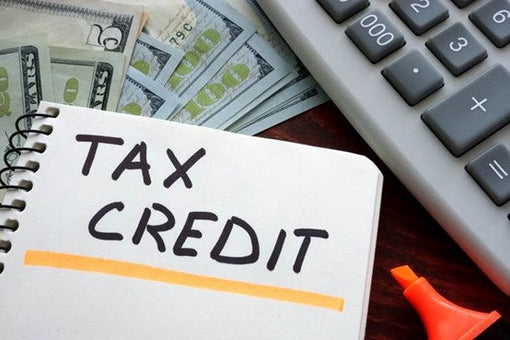

Federal Solar Tax Credit

The nationwide 30% federal solar tax credit further reduces the cost of solar system installation. It covers labor, cost of materials, permit, and developer fees, among others. Scheduled to run till 2034, it provides the most comprehensive incentive to any homeowner in Ohio. The credit however reduces to 26% from 2033 and 22% in 2034.

So, if you want to enjoy the 30% tax credit, you should install a solar system between now and 2032. You must own the solar system and it should be within US territory.

Net Metering

Ohioans can also benefit from net metering. Offered by some of the largest utility companies in Ohio, it allows you to export excess electricity to the grid in exchange for energy credits. The best thing is Ohio offers better credits than California and other states. So, when your solar system is not producing ample energy, you can draw electricity from the grid, against the credits you have amassed.

Unlike other states, all solar systems in Ohio qualify for net metering. Whether you installed your system in 2010 or 2022, you can export electricity to your utility grid. Most homeowners will accumulate credits during summer and use them during winter. Some of the utility companies offering net metering include:

- AES Ohio

- AEP Ohio

- Duke Energy Ohio

Is It Worth Installing a Solar System in Ohio?

Yes, installing a solar system in Ohio is a viable investment. As electricity bills in Ohio increase, investing in a robust solar system can help you save money. Granted, you’ll have to contend with high initial installation costs, but you’ll enjoy many benefits.

For example, your energy bills will reduce depending on the type of system. If you install a robust unit, you totally offset your energy bills. Furthermore, you will benefit from net metering, allowing you to sell excess electricity for energy credits. You can then redeem them during winter or overcast conditions.

Besides lowering your electricity bills, you become energy independent, meaning you don’t have to rely on your utility company to power your home. And, you can keep lights on and appliances running during power outages. You can achieve this by installing the BLUETTI 2*AC300 + 2*B300 + 1*P030A.

Since solar energy is clean and renewable, you will significantly reduce your carbon footprint. And if you want to increase the value of your home in Ohio, installing a solar system is the perfect bet.

FAQs

Which cities in Ohio offer local solar incentives?

Cincinnati and Cleveland offer local incentives to their residents. However, you should meet certain requirements to qualify. Residents in Hamilton County can also apply for the Hamilton County Home Improvement Program. It can offset much of the installation cost allowing you to go solar at a reduced price.

Which solar incentives can apply for in Ohio?

State-level incentives include:

- Net metering

- Solar sales tax exemption

- Ohio Property-Assessed Clean Energy financing

- Solar Renewable Energy Credits (SRECs)

Final Thoughts

Ohio offers its residents multiple solar incentives allowing them to go solar at little to no cost. They range from net metering to solar sales tax exemption, and local incentives such as Hamilton County Home Improvement Program. Going solar in Ohio allows you to be energy independent so you can keep your appliances running even in power outages.

Shop products from this article

Be the First to Know

You May Also Like

What Does a 30% Federal Solar Tax Credit Mean and How to Apply?

Governments around the world are offering programs that encourage homeowners to switch to solar energy. Among the most notable programs is the 30% Federal Solar Tax Credit. It reduces your...

Deadly Flooding Devastates U.S. South and Midwest — What You Need to Know