Your cart is empty

Shop our productsThe One Big Beautiful Bill Act (OBBB), passed in 2025 in the US, is one of the most significant shifts in the federal tax and spending policy in recent years. OBBB contains everything from taxation to energy and housing, which puts the financial picture of American households in a different light, especially for homeowners. The bill contains some new opportunities and altered incentives.

Therefore, it is necessary to know what it contains to make wise decisions about your house, energy use, and long-term financial planning. In this "Understanding OBBB: A Simple Guide for Homeowners," we'll unpack this bill, sharing crucial details that relate directly to residents, particularly solar energy adopters. So that you can better take advantage of the benefits of the bill and avoid the pitfalls!

What Is OBBB?

The One Big Beautiful Bill (OBBB), enacted on July 4, 2025, is a large US federal law that combines many policy changes into one package. It discusses taxes, energy, health care, and housing. The bill is projected to fire up the economy, reduce taxes for families, and push towards energy independence, but it is also a massive blow to clean energy subsidies. Here are its main features:

-

Clean Energy Investment

According to the OBBB, it is aiming to help the country achieve energy independence. Yet when we consider the actual work it has ended up doing, we see that it has reduced investment in clean energy. Instead, it's pushing for more investment in fossil fuels. The biggest alteration is the premature phasing out of the 30% federal solar tax credit (ITC), which is now set to expire at the end of 2025 rather than gradually diminishing over 10 years.

The bill also eliminates credits for leased solar systems, which is currently the only way many families without large upfront investments can go solar. Beyond that, there is a stringent regulation that would exclude expensive solar equipment from some foreign manufacturers, increasing the cost and delaying the installation. Analysts have cautioned that the changes can translate into reduced solar projects, increased expenses for homes, as well as significant losses of jobs in the renewable energy industry.

-

Tax Benefits

The OBBB promises tax cuts and a simpler tax code, but the results are a mix of permanent, temporary, and targeted benefits. Many of them are tilted toward higher earners and corporations. It locks in several 2017 TCJA changes, including the cap on mortgage interest deductions for loans up to $750,000. It introduces new deductions for tips, overtime, and auto loan interest, and a $6,000 deduction for senior citizens between 2025-2028.

From 2025 to 2029, the SALT deduction cap is expanded temporarily to $40,000 from $10,000, greatly relieving homeowners who are in higher-tax states. It also permanently extends the deduction for Mortgage Insurance premiums (PMI). While these changes help many homeowners, they are expected to add trillions to the federal deficit.

-

Cost Reductions

The OBBB aims to ease financial pressure on families, but its impact is mixed. Extended and new tax deductions would reduce their federal tax payments every year and save many households some money. However, the bill risks stifling the expansion of cheaper solar and wind power by reducing renewable energy incentives. This will keep homeowners more dependent on the traditional grid system and fluctuating fossil fuel costs.

When the 30% solar tax credit ends after 2025, it will increase the cost of solar by 30 % upfront, thus making solar unaffordable to many people. On the whole, families will experience minimal tax relief with longer-term cost increases in energy and less ability to reduce utility expenses through solar.

How OBBB Affects the Federal Solar Tax Credit?

As you now know, the OBBB makes major changes to the federal solar tax credit. Let's find out how it affects the credit and what the savings look like for typical system sizes.

-

Expiring Residential Clean Energy Credit (25D)

The 30% tax credit to the owners who install solar facilities in their homes (Section 25D) no longer gracefully fades away in 2034. Rather, it ends on December 31, 2025. To be eligible, systems must be installed and fully operational before the deadline. This credit is applicable to solar panels, batteries that are at least 3 kWh capacity, wind turbines, and other qualifying clean energy assets.

-

Third-Party Systems (Leases/PPAs) Have a Longer Credit Life

Credits claimed by homeowners expire at the end of 2025, whereas those that are third-party systems under Section 48E won't expire until December 31, 2027. In such instances, the leasing company keeps the credit and usually transfers savings to homeowners by offering them lower monthly payments.

-

Stringent Rules for Utility-Scale Projects

The solar and wind projects will need to start construction by July 4 in 2026, and be put in service by the end of 2027 to benefit from tax credits. New rules tighten the standards of when construction starts, call for stricter documentation, and reduce safe harbor opportunities.

-

Foreign Entity of Concern (FEOC) Restrictions

Negative effects of using solar parts sourced from "covered nations," such as China, Russia, Iran, or North Korea, could make projects ineligible to claim tax credits. They must also satisfy domestic content requirements, such that 45% of materials in 2025 must be U.S.-sourced, with this rising to 55% in 2027.

-

End of Other Clean Energy Incentives

Other clean energy incentives like the electric vehicle (EV) tax credits will expire on September 30, 2025. However, if a buyer signs a binding contract and pays by September 30, 2025, they can still get the credit even if the vehicle is delivered later.

Examples of Savings that a Homeowner Can Enjoy (Up to December 31, 2025)

As mentioned, homeowners can claim a 30% credit of the cost of solar equipment and installation when that installation is made prior to the deadline. Here's how you can save through common solar + battery systems:

|

System Size |

Solar Cost (at $3.00/watt) |

Battery Cost (at $1,300/kWh) |

Total Cost |

30% Tax Credit Savings |

|

5 kW Solar + 5 kWh Battery |

$15,000 |

$6,500 |

$21,500 |

$6,450 |

|

10 kW Solar + 10 kWh Battery |

$30,000 |

$13,000 |

$43,000 |

$12,900 |

|

20 kW Solar + 20 kWh Battery |

$60,000 |

$26,000 |

$86,000 |

$25,800 |

What Do the Other Energy-Related Provisions in OBBB Say?

The OBBB impacts more than just solar. It also alters policy on fuel cells, nuclear, fossil fuels, carbon capture, clean fuels, and manufacturing, adds new policies, and increases requirements on specified projects. The other major energy-related stipulations are as follows:

-

Other Technologies and Fuel Cells

Other technologies, such as battery storage, geothermal, hydropower, and nuclear, keep favorable tax treatment, with phaseouts beginning in 2034, following the original Inflation Reduction Act (IRA) schedule.

Fuel cell projects, including linear generators, that start construction after 2025 can claim a 30% ITC without emissions or prevailing wage requirements. But they are not eligible for additional bonuses like domestic content incentives.

-

Fossil Fuel and Nuclear Energy Support

The OBBB provides new support for nuclear and fossil fuel energy. For nuclear power, the bill adds a 10% bonus credit under Section 45Y for advanced facilities located in areas with historic nuclear employment. It aims to expand U.S. nuclear capacity from 97 GW to 400 GW by 2050.

For fossil fuels, the bill introduces tax credits for oil and gas production. Metallurgical coal used in steelmaking qualifies under Section 45X at 2.5%, compared to 10% for other critical minerals. The bill also repeals the IRA's methane fee, reducing compliance costs for fossil fuel operators.

-

Carbon Capture and Clean Fuels

The OBBB updates carbon capture and clean fuel incentives. Under Section 45Q, credits for carbon sequestration, increased oil recovery, and commercial use are set at $85 per metric ton, with higher rates for direct air capture. Projects must follow FEOC ownership rules but are not subject to material assistance restrictions.

Section 45Z extends credits for clean transportation fuels, like sustainable aviation fuel, until December 31, 2029. Though the credit for sustainable aviation fuel drops from $1.75 to $1.00 per gallon for production after 2025. The rules also prohibit "negative emissions" claims and require feedstocks to come from the U.S., Mexico, or Canada.

-

Advanced Manufacturing (Section 45X)

Under Section 45X for advanced manufacturing, credits for wind components end for sales after 2027. Furthermore, credits for critical mineral production (except metallurgical coal) phase out after 2030 and fully terminate by 2033. Manufacturers can claim multiple credits for integrated components made in the same facility and sold to unrelated buyers, as long as 65% of material costs come from U.S. sources.

-

Bonus Depreciation and Direct Pay

The OBBB restores full bonus depreciation (100%) on qualified property, including some energy projects, placed in service before January 1, 2028. At some point, the bonus will be phased down to 80% in 2028, 60% in the year 2029, and 40% in 2030.

It also keeps direct pay (Section 6417) for tax-exempt entities like nonprofits and municipalities, and transferability (Section 6418) for selling credits, though new rules restrict transfers to FEOCs.

-

Regulatory and Bureaucratic Barriers

Solar and wind projects now undergo higher scrutiny by the Department of the Interior in terms of either leases, grants, or permits, and this may delay approvals. The Treasury must issue new guidance by mid-August 2025 to tighten "beginning of construction" rules, limiting safe harbors unless a substantial portion of the facility is built.

How to Take Advantage of OBBB Benefits For Homeowners?

The OBBB provides a mix of temporary and permanent benefits for homeowners. Here's a quick look at the ones you could take advantage of:

-

Claim Solar Tax Credit: Homeowners will be able to claim the credit against solar systems put in place on primary or secondary homes (but not rentals). But provided that they have the necessary tax liability. To receive the claim, you should fill in the IRS Form 5695 with your 2025 income tax return. The credit cannot be refunded. It can only be carried forward. Be swift in making arrangements to install the system and retain the contracts, invoices, and photographs of the date of installation.

-

Homeowners Using Leases or PPAs: Instead of buying solar systems, homeowners should choose reputable installers who can meet "begin construction" requirements, such as safe harboring equipment. Projects must also follow FEOC rules for work after 2025.

-

SALT Deduction Boost: Homeowners in high-tax states who itemize deductions can claim this benefit on Schedule A of their tax return. Remember that certain states may not conform to the federal change, so please look at local regulations.

-

Mortgage Interest Write-Off: It is permanently retained for loans to a maximum of 750,000. Mortgage holders of first or secondary residence houses can claim it by itemizing their deductions in Schedule A.

-

Dependent Care Assistance Program (DCAP): It expands the annual tax-free contribution amount to the limit of $7,500 or higher beginning in 2026. Those homeowners who have dependents younger than 13 and who are on employer-based plans are at liberty to make changes to contributions during the open enrollment period.

-

Energy-Efficient Home Improvements: This includes the tax credits until 2026 on energy-saving improvements such as windows and insulation under Section 25C. Homeowners will have to make their renovations and repairs before the deadline and retain their receipts.

-

100% Bonus Depreciation for Home Businesses: Homeowners with qualifying home-based businesses can claim this deduction by reporting it on Schedule C or their business tax returns.

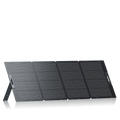

Why Pair Solar with Battery Storage?

Solar power coupled with batteries is becoming one of the wisest decisions consumers can make under OBBB. A solar + battery-powered system is a low-cost and efficient way to power basics during blackouts, keeping lights, laptops, smartphones, and fridges functioning. It's also crucial as extreme weather and grid instability grow, and it's effective too.

Solar and batteries also qualify for the federal tax credit through the year 2025, after which the credit will end for systems owned by homeowners. To take one such example, a $15,000 battery has a value of $10,500 with the credit presently, but will have a value of $15,000 after 2025.

Batteries also help maximize savings by storing solar energy produced during the day and using it at night. This is especially when utilities charge high Time-of-Use rates (like 4–9 PM) or when net metering pays only a few cents per kWh while charging you much more.

Environmentally, batteries reduce reliance on fossil fuel "peaker plants" and cut your carbon footprint. Furthermore, they future-proof your home by supporting EV charging and boosting property value, as buyers increasingly value homes with solar plus storage.

A solar + battery powered system like the BLUETTI AC200L offers a 2,400W output, a 3,600W surge power, and a 2kWh battery capacity. This is enough to run heavy loads for a short period and basics during lengthy outages. You can also add more batteries to the unit to extend its battery capacity to 7.6kWh to juice up critical appliances like a CPAP machine for even longer.

During unpredictable power cuts, it also provides a 24/7 UPS. You can charge the AC200L with an AC input up to 80% in just 40 minutes, and it also powers up quickly with a 1200W solar input. Other methods to charge the unit include a wall outlet, a car charger, dual AC+DC, or a generator.

If you want to run heavy loads for longer periods, another solar + battery-powered system like the BLUETTI Apex 300 is ideal for that. It boasts a 3,840W output and 2,764.8Wh battery capacity. You can extend both the output and capacity to 7,680W and 58kWh, respectively, by placing two units in parallel and adding more batteries. This extended power is sufficient to run basics like laptops, smartphones. LEDs, WiFi, along with power-hungry appliances like a small window AC during peak hours, or off-grid living.

Besides, during unexpected power cuts, the Apex 300 offers a 0ms UPS backup. You can charge the unit with an AC input up to 80% in 45 minutes and with a SolarX 4K and AT1 solar input up to 30 kW. Other methods to charge the Apex 300 include a generator charging. The unit also comes with weather alerts, auto charging in bad weather, and a 12kW bypass for EV charging. Both AC200L and Apex 300 are portable enough to carry for camping, travelling, off-grid living, or to install in RVs.

Financial Planning For Homeowners to Obtain Maximum Benefit From OBBB

The OBBB creates a time-sensitive opportunity, such as you can accelerate 2025 investments to claim expiring credits and maximize tax benefits. So, to make sure you qualify, ask your tax consultant certain questions, then estimate the payback period for your solar + storage system. Here's how to do that:

Tax Professional Consultation

Here are the key questions you must ask a CPA or tax advisor and the installation documentation you should prepare:

Key Questions to Discuss:

-

Full 30 % Credit: Do I have sufficient tax liability to claim it? The credit is not refundable but is carried forward for future years.

-

Tax Interactions: How do the SALT increases, mortgage interest, new tax deductions tips and overtime, and auto loan interest affect your Adjusted Gross Income (AGI) and overall taxes?

-

AMT Impact: Will the credit be able to be claimed under the Alternative Minimum Tax (AMT)?

-

Financing Decisions: Should you take a solar loan, and how do tax savings offset payments?

Documentation to Prepare:

-

Signed installation contract and final invoice showing payment.

-

Installer confirmation that the system was placed in service in 2025.

-

Manufacturer spec sheets for panels and batteries.

Estimating Payback Periods for Solar + Storage Systems

The payback period is the time it takes for energy savings to cover the net cost of your solar system. The OBBB's 30% federal tax credit significantly shortens this period, but acting quickly is key. Here's the simplified payback formula and an example of payback period for a typical home system, and some variables that shorten payback:

Simplified Payback Formula:

Payback Period (years) = Net System Cost ÷ Annual Energy Savings.

-

Net System Cost = Total Installed Cost − Federal Tax Credit − State/Local Rebates.

-

Annual Energy Savings = Annual kWh Production × Electricity Rate ($/kWh).

Example:

-

10 kW solar + 10 kWh battery, installed cost $45,000.

-

Federal credit: $13,500; state rebate: $1,000 → Net cost = $30,500.

-

Annual production: 14,000 kWh × $0.30/kWh → $4,200 savings/year.

-

Payback period ≈ 7.3 years.

Additional Factors That Shorten Payback:

-

Increasing electricity rates (2-4% a year) convey additional cost savings in the long term.

-

Battery storage has value by shifting loads and providing backup.

-

SRECs or net metering can cut payback to 5–6 years.

-

With financing, tax credits can make monthly energy costs immediately positive.

FAQs

-

Does the OBBB offer any benefits for homeowners beyond solar?

Yes. The OBBB offers key benefits for homeowners. Between 2025 and 2029, the SALT deduction cap is raised temporarily to $40,000, and this is particularly beneficial in high-tax states. It also permanently reinstates the insurance on the mortgage premium (PMI) and maintains the limit of $750,000 on the mortgage interest deduction.

-

How does the OBBB impact the broader clean energy industry?

The OBBB is likely to have a profound effect on the American clean energy industries by phasing out major incentives prematurely. This will leave them in a state of indecision and rushed timelines. Reductions in the installation of solar and wind energy are expected to be as high as 17-46% by 2030, bringing with it 250,000 potential job losses. Moreover, with the phase-out of incentives, it is predicted that investment will move to nuclear, batteries, and fossil fuels.

-

I have a low tax liability. Can I still use the full solar tax credit?

Yes, the benefit may still be utilized. The residential tax credit for solar cannot be refunded, so it can only reduce federal taxes to zero, not provide a refund. But even unused credits can roll over into future years until they are exhausted, so you can take full advantage of the amount in the long run.

-

What is the single most important action I should take now regarding the OBBB?

When considering the possibility of going solar, the first and foremost thing is to start doing it now. The federal tax credit of 30% expires on December 31, 2025. But it takes months to install a system. So, this may leave consumers unable to install a system before the tax credit expires. Shop around and get quotes on installers, and consult a tax professional early. So that you can be sure that you will qualify and complete in time to earn the credit.

Conclusion

So, that was all to the "Understanding OBBB: A Simple Guide for Homeowners." The One Big Beautiful Bill and the solar tax credit are both beneficial and problematic for US homeowners. It comes with short-term breaks such as the 30% solar and battery credit, elevated SALT deductions, and new deductions for families. However, there are future cuts to support clean energy. But now is a good time, before December 2025, to install solar with a battery storage system. This will guarantee low costs, quicker payoff, and protection against future increases in pricing and power outages.

A solar + battery powered system like the BLUETTI AC200L offers a 2,400W output and expandable storage with fast solar and AC charging. The larger energy requirements can be satisfied by the modular design of the BLUETTI Apex 300. It boasts an increased 7,680W output and high capacity by combining two units and adding more batteries. The unit also offers EV charging. Both the AC200L and Apex 300 provide homeowners with smart, forward-looking solutions to reap the maximum benefits of OBBB for becoming energy independent.

Shop products from this article

You May Also Like

Why Meteorological Winter Matters for Planning, Safety, and Energy Management