Your cart is empty

Shop our productsAlmost every citizen of the United States is concerned about inflation right now. Everything from gas to groceries to rent has increased in price. Taking charge of your electricity bill is one of the best ways to shield your finances from consistent price increases.

The costs associated with energy are expected to continue rising due to multiple factors, such as inflation, international relations, and climate change – and already consume a significant portion of our monthly budget. But you can lock in an electricity rate for the next two decades and, consequently, protect yourself from the skyrocketing energy prices.

How can you make this happen? By going solar. This article will show you how to use solar energy to save money, and why you shouldn't wait any longer to get started.

A Brief History of Inflation

Inflation has averaged about 2% each year over the past several years, with a jump in 2022 when prices increased by more than 8%. Inflation rates are tracked by the Bureau of Labor Statistics, which also provides a decade-by-decade breakdown of those rates.

According to the Bureau’s data, yearly inflation has ranged between 0.1% and 2.4% during the years 2012 to 2020, with the highest rate of 2.4% being recorded in 2018. However, owing to the COVID-19 pandemic, inflation shot up to 4.7% in 2021, and, in 2022, it stood at a whopping 10.7%.

In other words, the cost of nearly all goods and services, including electricity generated by power plants, has been rising gradually over the past couple of years – drastically reducing the purchasing power of money.

A Brief History of Solar Prices

Installing solar panels on your home was quite pricey a decade ago. However, the solar cost has decreased substantially over the past few years, making it financially feasible for a far wider range of people to install solar panels.

In contrast to the general trend of inflation, solar energy prices are going down every year (there is a good reason why the Inflation Reduction Act of 2022 places such firm emphasis on renewable energy).

Another benefit of switching to solar is that the electricity generated by your panels will always cost the same.

According to a study conducted by the NREL (National Renewable Energy Laboratory), the price of a single watt of solar energy in 2010 was $7.53. In comparison, a watt of solar energy in 2022 costs just $2.71 – the lowest it has ever cost.

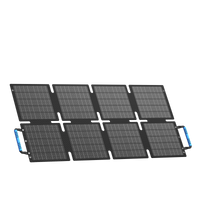

Portable Solar Panels As An Investment Tool

You can save a lot of money (potentially tens of thousands of dollars) over the course of a solar system's 25-plus-year lifespan by using it at your home. The cost of power is expected to rise in the future; however, if you install a solar energy system now, you may lock in your current rate. Due to the different types of solar loans out there, the vast majority of households can switch to solar power with zero upfront costs and immediately begin saving money.

Below are a few reasons why a portable solar panel system is one of the best investment options out there:

Excellent ROI (Return on Investment): While most investments are either high-risk or low-return, solar is low-risk (usually covered by a lengthy warranty) and high-return.

Assured Returns: Solar profits are guaranteed to increase as long as the sun continues to shine, protecting your investment from external factors, such as a global epidemic or the wildly shifting stock market.

Tax-Free: Gains from solar energy are generally derived from monthly savings rather than profits and are therefore exempt from income taxes.

Hedge Against Inflation: The cost of home power is projected to increase by approximately 24% between the 10-year-period from 2012 to 2022. Installing solar panels can protect you against the ups and downs of electricity prices caused by fossil fuels like coal, oil, and natural gas.

Increase in Home Value: If you pay for your portable solar panels through cash or a loan, you can increase the value of your residence by an average of 4.1%.

Financing Options for Portable Solar Panels

We understand that solar panels, even portable ones, can feel like a huge investment. However, you must remember that, over their useful life, solar systems help save a lot more than what you initially paid for them.

Installing solar panels on your home and paying for them outright with cash will save you the most money in the long run because you won't have to worry about paying fees or interest on a loan.

But even if that is not possible for you, there are a number of other ways to start saving money through solar without forking over thousands of dollars.

$0-Down Loans

By getting a loan for your portable solar panel, you can instantly own your system and benefit from tax credits and rebates at the federal, state, and local levels, including the solar tax credit that allows you to deduct your portable solar panel cost by 26%. Zero-down payment loans with reasonable rates and terms of 15, 10, or 5 years are offered by a number of lenders these days. Your loan payment may be less than your monthly electricity cost, allowing you to start saving right away. Once the debt is paid off, you may not have to pay another electricity payment for years.

PPAs or Solar Leases

PPAs (Power Purchase Agreements) and solar leases were crucial in the early development of the solar industry, but they have fallen a bit out of favor in recent years. It's easy to confuse solar leases with PPAs because they both involve a third party owner installing solar panels on your residence and then selling you the electricity generated by those panels at a predetermined cost. Leases and PPAs operate slightly differently, but are close enough that they can be lumped together for convenience.

Power purchase agreements (PPAs) and leases can help you lock in a lower electricity rate for the following 25 years, generally by 10-30% below the amount you're presently paying. A common feature of solar leases and PPAs in the past was an annual payment increase known as an "escalator," but recently, it has become more common for leases and PPAs to be locked in at a single rate for the duration of the contract. In addition, a lease/PPA arrangement ensures that a third company will keep an eye on your solar panels by monitoring their performance and doing any necessary maintenance.

In a lease/PPA arrangement, the firm that owns the solar panel system will be eligible for any financial rebates or other incentives associated with solar, rather than the individual who is leasing or signing a PPA for the system. In addition, a lease/PPA may not increase the value of your home by the same amount as a solar system would without a lease/PPA, since you, the homeowner, are not the legal owner of the solar system.

Analyzing Your Solar Savings

After the payback time for your solar panels has passed, the amount you save will go into your pocket instead of that of the utility company. Keep in mind that if electricity prices rise due to inflation, your payback period may decrease. Your ability to realize net savings through the solar panel system is inversely proportional to the amount of money you save by reducing or eliminating your electricity use from the utility grid.

Plus, when the cost of conventional electricity increases, your savings from the solar panels should increase. If your solar panels can provide most of your energy needs, you won't see any significant increases in your monthly bills. As a result, putting money into solar panels can alleviate stress about whether or not you will be able to keep up with future increases in your electricity bill.

When solar panels produce more energy than a residence needs, the homeowner can also sign up for net metering. In a net metering arrangement, the utility company will credit your account for any electricity you supply to the grid, which can be used to reduce your cost in the future.

Portable Solar Panels As An Inflation Hedge

The multiple ways in which portable solar panels help you save money can considerably mitigate the impact of inflation in various aspects of your life.

Mortgage Reduction

Solar savings can be a significant factor in offsetting a mortgage rate hike, depending on the kind of mortgage on your home.

If installing solar panels helps you save money on your energy bills, you might put that extra cash toward reducing your mortgage balance.

Food

Inflation usually has a major impact on groceries. If you cut back on your energy use, you will have more cash for groceries. This includes purchasing in bulk those frozen foods that can be stored in a freezer which is now run on cheap electricity provided by portable solar panels.

Entertainment

Your 'fun money' is typically what is left over each month after essential expenses have been covered.

With solar panels, your monthly electric bill will be lower, leaving you with more disposable income to enjoy the movies or take a trip.

Furniture

Bedding and furniture are two more commonly overlooked but crucial household items that are significantly affected by inflation. You could buy a brand new sofa and sheets with the money you save by switching to solar power.

Investing in better-made goods can increase your happiness and satisfaction with life – not to mention their longevity in comparison to cheap alternatives.

New Vehicle

By installing portable solar panels and reducing your electricity bill, you can now catalyze the process of saving enough money for your favorite car. Both the value of new and used cars has gone up since the pandemic, and, thus, the extra cash in hand can go a long way in making a new vehicle purchase possible for you.

Soften The Inflationary Blow With Portable Solar Panels

Even though the price of electricity has risen consistently over the years, you can protect yourself from future hikes by switching to solar panels. As the initial outlay for a solar power system has dropped over the past decade, renewable energy has emerged as one of the most promising hedges against inflation.

Once you see out the payback period for your solar panels –which is significantly low for portable solar panels than for conventional, roof-installed ones –you can start saving money every month. After that, you might use the surplus funds to offset the effects of inflation in other areas, such as food, mortgage interest, furniture, conveyance, and entertainment.

If you are interested in buying portable solar panels to protect yourself against inflation, we invite you to check out our wide range of options. We offer many different types of portable solar panels, generators, and kits, and can help you choose one based on your location, energy needs, budget, and saving targets.

Shop products from this article

Be the First to Know

You May Also Like

What Does a 30% Federal Solar Tax Credit Mean and How to Apply?

Governments around the world are offering programs that encourage homeowners to switch to solar energy. Among the most notable programs is the 30% Federal Solar Tax Credit. It reduces your...

Deadly Flooding Devastates U.S. South and Midwest — What You Need to Know