Your cart is empty

Shop our productsAs California is known for its sunny weather, it is no surprise that the state is also a leader in solar energy investment. California offers incentives to homeowners and businesses to invest in solar energy systems, including tax credits and rebates. In this article, we will discuss why these incentives are important, how they can help you save money, and how to access them. Investing in solar energy can be a great way for Californians to reduce their carbon footprint and help the environment while also saving money on their energy bills.

Current status of California State Solar Incentives

California boasts some of the most generous solar incentives in the country. As of 2020, there are two main types of solar incentives available to homeowners and businesses: tax credits and rebates. The California Solar Initiative (CSI) provides over $2 billion in cash incentives to residents and businesses that install solar PV systems on their properties. Tax credits are available for both residential and commercial solar installations, while rebates are available for residential solar installations only. Both CSI and other federal tax credits cover up to 30% of the installation cost.

The CSI program is now in its third phase, which started in 2016. This phase focuses on offering sizable incentives to homeowners and businesses who install solar PV systems with battery backup. In addition to the CSI, the federal government offers a solar Investment Tax Credit (ITC) worth 30% of the total installation cost. The ITC is set to decrease to 26% in 2021, 22% in 2021, and 10% in 2022.

In addition to state and federal incentives, many California utilities also offer their own rebates and other incentives. These programs vary by utility and can offer up to an additional $1,000 in cash incentives for a residential solar installation. Many cities and counties across the state also offer grants and other incentives for solar installations.

California also offers an assorted of other incentives that can help offset the cost of solar installation. These include property tax exemptions, net metering, and performance-based incentives. Net metering allows solar customers to get compensated for the excess energy they generate with their solar system, while performance-based incentives provide additional incentives for energy generated above a certain level.

California has made great strides in its commitment to renewable energy and solar incentives. By taking advantage of all of the available incentives, homeowners and businesses can significantly reduce the overall cost of installing solar and realize a greater return on their investment.

Solar Incentives, Tax Credits, and Rebates in California

California is one of the top states in the nation for solar energy, and the state offers generous incentives to residents who install solar on their homes and businesses. The incentives include tax credits, solar rebates, net metering, and the VDER Value Stack. The state also offers a sales tax exemption and a property tax exemption for those who install solar.

The California Solar Initiative (CSI) is a state incentive program that offers up to $1 billion in tax credits for residential solar installations. Each year, there is an annual cap on the amount of CSI funds available, so it is important to plan ahead and apply for the credit as soon as you can.

The California Solar Initiative (CSI) also offers a solar rebate for residential and commercial installations. The amount of the rebate varies depending on the size of the system and the type of installer, but can range from $600 to thousands of dollars.

California also offers net metering, which allows customers to receive credits on their electric bills for the electricity their solar systems generate. Net metering can help customers save money on their energy bills, and can be a great incentive for those who want to go solar.

The VDER Value Stack is a new incentive program designed to reward customers for the value of the electricity their solar systems produce. It also helps ensure that solar energy is more affordable for all Californians. Customers can receive credits on their electric bills for the value of the energy their solar systems generate.

California also offers a sales tax exemption and a property tax exemption for those who choose to install solar systems on their homes or businesses. This can mean significant savings for those who install solar. This combined with the other incentives can make going solar an even more attractive option.

All of these incentive programs combined make California one of the most attractive states for solar energy. With the tax credits, solar rebates, net metering, and the VDER Value Stack, California incentives are some of the best in the nation. For those considering solar, these incentives are worth considering.

Estimated Solar Savings in California

California’s solar incentives make going solar more attractive and cost-effective. These incentives include tax credits and rebates that lower the cost of solar installation. Depending on the size of the solar system and the size of your home, you could save as much as hundreds to thousands in upfront costs and energy bills.

The payback period is an estimate of the amount of time it will take you to make back the money you spent on your solar installation. To calculate this, divide the total cost of installation, minus any tax credits, by your energy savings per year. For example, if the cost of the solar system is $20,000 and the tax credit is $2,000, the system cost after the tax credit is $18,000. If the estimated energy savings for the year is $5,000, the payback period is 3.6 years.

As you can see, investing in a solar system can be a great way to save money on your energy bills. With the generous tax credits and rebates offered in California, it is often easy to make the payback period shorter than expected. If you think solar might be a great fit for your home, research local solar companies and get a free quote to see what your estimated savings could be.

California Solar Incentives Available in 2023

California is at the forefront of renewable energy and solar incentives. With some of the best incentives available for solar installations, Californians can take advantage of the state's commitment to reducing emissions. In 2023, a variety of incentives and tax credits are available to Californians who are interested in going solar. These include the Investment Tax Credit, Solar Energy System Property Tax Exemption, California Solar Initiative, and Net Energy Metering.

The Investment Tax Credit (ITC) is a federal incentive that allows solar installers to claim up to 30% of their costs as a federal tax credit. This incentive is ongoing and applies to both residential and commercial solar projects. This incentive is especially attractive for those who are looking to offset the high upfront costs of going solar, as it can significantly reduce the cost of the project.

The Solar Energy System Property Tax Exemption is a state-level incentive that exempts solar installations from property taxes. This incentive applies to residential and commercial solar projects and is available every year. This incentive is especially useful for those who wish to offset the cost of installing a solar system and reduce their property's taxes.

The California Solar Initiative (CSI) is a state-level incentive that provides rebates to solar installers. The amount of the rebate depends on the size of the project and the system type. The CSI is available to both residential and commercial solar projects and is offered annually in tiers. This incentive is especially valuable for those who wish to benefit from the rebates and offset their solar costs.

Lastly, the Net Energy Metering (NEM) program is a rate structure that credits solar installers for excess electricity they generate. This program is available to both residential and commercial solar projects and is ongoing. This incentive is especially beneficial for those who generate a lot of excess electricity and want to see a return on their solar investment.

California is a leader in solar incentives and has some of the most attractive incentives available. In 2023, solar installers can take advantage of the Investment Tax Credit, Solar Energy System Property Tax Exemption, California Solar Initiative, and Net Energy Metering program to offset the cost of their projects and reduce their electric bills. For those interested in going solar, these incentives are an excellent way to reduce the cost of the project and lower their carbon footprint.

California is the leading state in solar energy, and for those looking to invest in their own solar energy systems, there are dozens of solar installers to choose from. We’ve compiled a list of some of the top solar power installers in the state, along with a brief introduction to their services, what they’re best for, and the cost of an 8kW system from each company. We’ve also taken into account their Better Business Bureau (BBB) rating.

SunPower

Brief Introduction: SunPower designs, manufactures and sells high-efficiency solar electric systems and services. They offer a 20-year warranty on their systems and provide customers with a seamless and worry-free experience.Best For: Those who are willing to pay a premium for top-of-the-line solar panels and installation.

Cost of 8kW System: $25,000 - $30,000+

BBB Rating: A+

Tesla Solar

Brief Introduction: Tesla Solar is one of the leading solar energy companies in the world, offering both residential and commercial solar energy solutions. They provide customers with innovative products and worry-free services.Best For: Those who want a well-known, reliable solar installer with innovative products.

Cost of 8kW System: $20,000 - $25,000

BBB Rating: A+

Eco Solar

Brief Introduction: Eco Solar is a full-service residential solar energy provider with an A+ rating from the California Energy Commission. They offer expert installation and top-of-the-line products.Best For: Those looking for a reliable solar power installer with competitive pricing.

Cost of 8kW System: $14,000 - $18,000

BBB Rating: A+

Sungevity

Brief Introduction: Sungevity is a solar energy company that specializes in residential and commercial solar energy solutions. They provide comprehensive customer service with experienced in-house installers.Best For: Those who want an experienced solar panel installer with a comprehensive customer service department.

Cost of 8kW System: $15,000 - $20,000

BBB Rating: A+

SolarCity

Brief Introduction: SolarCity provides integrated solar energy systems for both residential and commercial customers. They have a wide range of products to choose from and offer competitive financing options.Best For: Those looking for competitive financing and a wide range of solar energy products.

Cost of 8kW System: $18,000 - $22,000

BBB Rating: A+

Which Solar System Is Right for Your Home?

When deciding on a solar system for your home, there are several factors to consider. First, you should determine what size system you need by researching your home’s energy consumption and the amount of electricity you use each month. Additionally, it is important to consider the angle and orientation of your roof and the climate in your area, as these factors can affect the efficiency of your system. Additionally, you should weigh the benefits and drawbacks of the different types of solar systems available, such as roof and ground mounts, and compare those options to the cost of your system. when choosing a solar system, you should take into account the tax credits and rebates offered by California that can help you finance your system. With careful consideration of the factors mentioned above, you can select the solar system that best meets your needs and budget.

1. What are the requirements for taking advantage of solar incentives in California?

In California, homeowners must meet certain requirements in order to take advantage of solar incentives. To qualify, homeowners must have an active account with their local utility company, residence must be located within the state of California, and they must install a solar electric system that meets the standards of a qualified, certified solar contractor.

Additional requirements for solar incentives in California include:- The solar system must be connected to the utility grid.

- The system must be sized to meet the customer’s total energy needs, either as a whole or in increments.

- The system must be in operation and generating energy.

- Systems must generate at least 1 megawatt of energy.

- The system must have a warranty for 25 years.

- The solar installation must be a permitted system and inspected by the local authorities.

- The system must comply with all local, state, and federal laws and regulations.

- The solar installer must be a licensed contractor.

- The homeowner must be in good financial standing with their utility company.

Additionally, the customer must purchase their solar system outright and have proof of ownership for the system. Customers may also be eligible for additional incentives or credits from the local utility companies.

2. Are there any restrictions on the size of solar systems that qualify for solar incentives?

Yes, there are restrictions on the size of solar systems that qualify for solar incentives. Solar incentives, also known as solar rebates, are offered by both the federal and state governments to reduce the installation cost of solar systems. The minimum size of solar system eligible for solar incentives will depend on the state and the type of incentive being offered. Generally, solar systems must be large enough to offset a majority of the home’s electricity needs. Some states may also require that the system be sized to offset at least 25% of the electricity needs. Different solar incentives may also have different requirements for the size of the solar system.

It is important to check with your state and local government to see what size solar system is eligible for solar incentives in your area. Additionally, it is important to contact solar installers in your area to discuss the size of solar system that is right for your needs.

3. How long do the solar incentives last?

The duration of solar incentives are determined by the individual programs and policies set by each state. Many states offer incentives such as tax credits, grants, and rebates that can be redeemed for discounts on the installation of a solar energy system. These incentives can last for a number of years, depending on the state, and can sometimes span multiple incentives cycles. In some cases the incentives may end when a certain funding level is reached, so it is important to keep an eye on updates in incentive programs.

In addition to state-level incentives, the federal government also offers a tax credit of up to 30 percent of the cost for installation of a solar energy system. This can be used to offset the cost of solar installation and can be claimed as part of the homeowner's income tax. This credit is set to expire in 2021, so it is important to take advantage of it while it is available.

In general, the incentives that are available will differ from state to state. It is important to research the incentives that are available in your state, and to take advantage of them while they are available. With the right incentives, you can save a significant amount of money on the cost of solar installation.

4. Are there any specific requirements for property owners to qualify for solar incentives?

Yes, property owners must meet certain criteria to qualify for solar incentives. Generally, these requirements fall into two categories: technical and financial.

Technically, property owners must ensure their solar system meets local and national codes and regulations. In some areas, for example, systems must use approved components and be installed by a qualified contractor. Furthermore, the system must be inspected and approved by the local building or fire officials before the incentives are made available.

From a financial standpoint, property owners must be able to demonstrate they can financially support solar investments. This could include providing proof of homeowners insurance, demonstrating adequate cash flow, or providing evidence of additional financing sources. Additionally, depending on the nature of the incentive, property owners may need to demonstrate compliance with income eligibility requirements.

Lastly, many solar incentive programs are available to a limited number of participants on a first-come, first-served basis. Thus, it is important for property owners to familiarize themselves with the incentives available and apply for them in a timely fashion.

5. Are solar incentives available for businesses in California?

Yes, solar incentives are available for businesses in California. The California Solar Initiative (CSI) provides incentives for businesses to install solar photovoltaic (PV) systems. Businesses can receive cash incentives or other financial incentives, depending on the type of PV system they are installing.

In addition, California’s net metering program allows businesses to get credit for the electricity their solar system produces that is fed back to the utility grid. This reduces the amount of electricity the business needs to purchase from the utility.

The California Public Utilities Commission (CPUC) also offers a Self-Generation Incentive Program (SGIP), which provides incentives for businesses that install solar PV systems. The SGIP provides up front and performance-based incentives for technology such as solar PV and other “green” technologies that reduce energy use and greenhouse gas emissions.

Businesses in California also may be eligible for federal and state tax credits. The federal Business Energy Investment Tax Credit (ITC) allows businesses to deduct up to 30% of the cost of installing qualifying technologies, including solar PV systems. The California Solar Tax Credit allows businesses to deduct up to 25% of the cost of their solar installation.

The future of renewable energy is bright; with government incentives, advances in solar technology, and the ever-growing awareness of our planet’s finite resources, solar energy is bound to become the go-to energy source of the future. California is leading the charge in solar energy adoption, and with the help of solar incentives, residents and businesses alike are being encouraged to make the switch to solar. With the potential to save money, reduce energy bills, and help save the planet, there is no better time to take advantage of California’s solar incentives.

You Might Also Like:

| Is electricity cheaper at night | What size generator to run a 2,000 sq ft house | Average electric bill in Ohio | Mini fridge wattage | My electric bill doubled in one month | Cost of heat pump for a 3,000 sq ft home | Difference between generator and inverter | Whole home battery backup | 1 simple trick to cut your electric bill by 90% | Average electric bill in Texas | How much is gas and electric per month | Roof replacement with solar panels | Los Angeles electricity cost | Average cost of solar panels in Virginia | What is shore power | Dallas solar incentives | Standing charges | One advantage to a pole-mounted solar array is that it... | High oil pressure causes | Best batteries for off-grid solar|

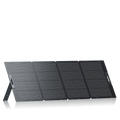

Shop products from this article

You May Also Like

Cherokee Electric Cooperative: Bill Pay, Outage Map, and Customer Service Guide

Cherokee Electric Coop is a local electric cooperative that provides reliable energy services to its members. This article provides important information about this cooperative, such as how to pay your...

Central Florida Electric Cooperative: Pay Bill | Outage Map | Customer Service | Phone Number

This article will discuss the services offered by Central Florida Electric Cooperative and provide customers with important information about how to pay their bills, check outages maps, get customer service,...

BVU Authority: Pay Bill | Check Outage Map | Customer Service | Phone Number

This article is all about providing readers with vital information about Bvu Authority, one of the leading utilities providers in the United States. We will cover topics such as how...